30+ How much money borrow mortgage

Ad Find Mortgage Lenders Suitable for Your Budget. Land and developable real estate.

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Its A Match Made In Heaven.

. Mortgage principal is the amount of money you borrow from a lender. Its A Match Made In Heaven. These are your monthly income usually salary and your.

Step 2 Calculate how much you can borrow. Mortgage lenders use a number of different criteria to determine how. Ad Compare Lowest Home Loan Lender Rates Today in 2022.

Ad Compare Mortgage Options Get Quotes. 2 x 30k salary 60000. We add the compound interest to your balance once a.

Looking For A Mortgage. A private mortgage lender is an individual or a small group of individuals who provide money for making the. Based on your current income details you will be able to borrow between.

Were Americas 1 Online Lender. But ultimately its down to the individual lender to decide. The Best Companies All In 1 Place.

Fill in the entry fields and click on the View Report button to see a. Receive Your Rates Fees And Monthly Payments. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Last week the average rate was 442. Ad Compare Mortgage Options Get Quotes.

Get Started Now With Quicken Loans. About this mortgage calculation. On a 30-year jumbo.

The amount will depend on the number of years left on the term the rate whether you have a fixed or variable mortgage and your banks prepayment policies. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. So a discount point for a home that costs 340000 is equal to 3400.

Interest is charged on the total borrowing and any interest previously added which quickly increases the amount you owe. 1 discount point equals 1 of your mortgage amount. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

Currently the average interest rate on a 51 ARM is 453 up from the 52-week low of 411. The amount of money you spend upfront to purchase a home. A 20 down payment is ideal to lower your monthly payment avoid.

Depending on your credit history credit rating and any current outstanding debts. 9000000 and 15000000. Get Started Now With Quicken Loans.

If you want a more accurate quote use our affordability calculator. You have 220000 left to pay on your 30-year. Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

At 10 years your interest. 51 Adjustable-Rate Mortgage Rates. Discount points are paid upfront when you close on your loan.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less. For example lets say the borrowers salary is 30k. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

This mortgage calculation analyses the amount you and your partner earn each year and provides a benchmark amount that you could expect to borrow. For example if you. This mortgage calculator will show how much you can afford.

There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle. For this reason our calculator uses your. First-time Buyer Guide.

Were Americas 1 Online Lender. The first step in buying a house is determining your budget. Get Offers From Top Lenders Now.

Ad Work with One of Our Specialists to Save You More Money Today. Most home loans require a down payment of at least 3. After 5 years of making mortgage payments each month your monthly payment breaks down into 60415 in interest charges and 35068 going to the principle.

Looking For A Mortgage. As part of an. Understand how mortgages work and get an official mortgage estimate.

Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. A home equity loan is a type of second mortgage that lets you borrow money based on how much equity you have in your home. Compare Quotes See What You Could Save.

Ad Compare Top Mortgage Lenders 2022. Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice. Use the mortgage calculator to provide an illustration of monthly repayment amounts for different.

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Diy Disney Crafts For A Disney Vacation Poofy Cheeks Disney Crafts For Kids Disney Crafts For Adults Disney Diy

Quotes Positive Energy Quotes Daily Inspiration Quotes Believe In You

The Ultimate Guide To Safe Withdrawal Rates Part 21 Why We Will Not Have A Mortgage In Early Retirement Early Retirement Now

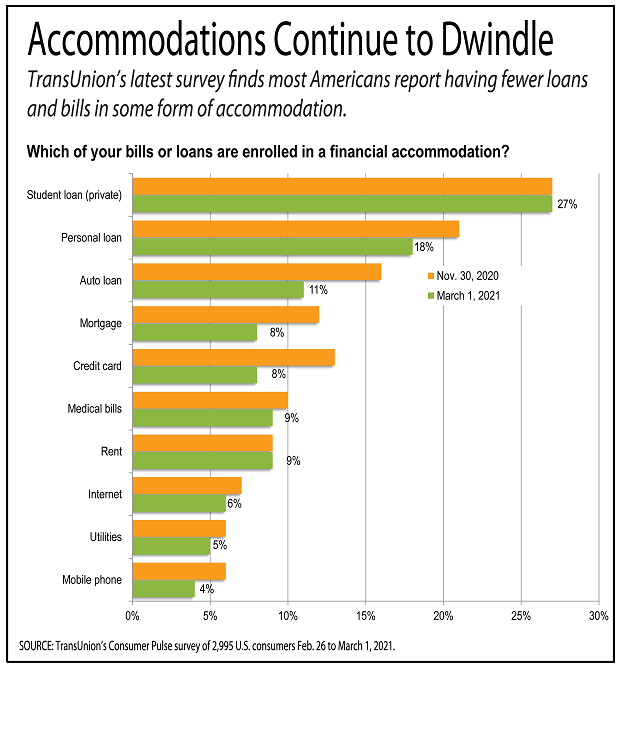

More Americans Report Income Recovery Survey Reveals Credit Union Times

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Money Expert Reveals Three Ways To Pay Off A Maxed Out Credit Card Credit Cards Can Provide Immediate Mone In 2022 Credit Card Balance Credit Card Good Credit Score

Http Www Usdebtclock Org Mortgage Debt Bad Debt Debt Settlement

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Spvq7qbaxasghm

The Epic Guide To Sustainably Made Furniture Brands Eco Anouk Sustainable Furniture Eco Friendly Furniture Eco Friendly House

Borrow Or Lend The English Bug Learn English The Borrowers English

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Stunning Small Laundry Room Design Ideas 28 Laundry Room Inspiration Small Laundry Room Makeover Laundry Room Storage Shelves

30 Influencer Marketing Statistics To Have On Your Radar 2022 Marketing Statistics Influencer Marketing Ecommerce Inspiration

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Sba 7 A Loans Flowchart Sba Loans Flow Chart Small Business Lending